Digital transformation of procurement and invoice processing

Purchase to pay often consists of fragmented sub-processes and unstructured documents and files. It is then unclear how much cash goes to the front end of a company, resulting in too much working capital being held and figures having to be corrected after the fact. With a data-driven and automated purchase to pay system, much more control over purchase to pay is gained.

Supply chain integration

The digital transformation of the purchase-to-pay process involves integration of the external and internal supply chain. Preferred suppliers are selected and contracted - including for tail spend. Products are offered centrally within the organization. With each order, a PO is created and submitted to budget holders for approval. The invoice that follows is automatically validated and matched with the corresponding PO. Accounts payable only follows up on the dropouts. Purchase prices and early payment discounts can be negotiated with preferred suppliers based on performance.

Benefits of purchase-to-pay automation

-

Reduce operational costs

Automating procurement (for indirect spend) and invoice processing (for both direct and indirect spend) can reduce the operational costs of these processes. Automation of the p2p process often starts with accounts payable. The process of manually receiving invoices, coding them, validating them, getting them approved by budget holders and submitting them for payment can be replaced by an automated process. In this process, invoices automatically reach budget holders, who can approve (or reject) invoices from a laptop or mobile phone, after which the invoice is submitted for payment. If procurement is also standardized and data-driven, approval can even be automatic. After all, there is no need to manually approve the invoice if it matches an order or contract that has been approved.

-

Improve agreements with suppliers

Negotiate lower purchase prices

When visibility, and therefore control, of order and invoice flows is gained, a critical look can be taken at how these flows relate to suppliers. For direct spend this will be clear, but for the long-tail to suppliers where stuff for the maintenance of company buildings, office supplies and marketing materials are bought, the challenge is greater. When orders and invoices are managed systematically it does become possible. The supplier base can be rationalized and pricing and delivery arrangements can be made with preferred suppliers.

Take advantage of early payment discount

By automating invoice receipt and invoice processing, turnaround time is reduced and a supplier can be paid more quickly. This, of course, calls for a reward. A large proportion of companies in the Netherlands suffer from invoices that are paid late. To encourage buyers to pay earlier, many suppliers give discounts for early payment of invoices. A payment discount of 1 percent is not unusual; 2 percent is also common. This may not seem like much, but the savings can add up nicely. Forrester research shows that companies with an annual spend of 300 million euros over a three-year period miss out on an average of about 400,000 euros in payment discounts. That makes a business case for purchase-to-pay automation a lot stronger.

-

Prevent invoice fraud

A PDF or XML invoice passes through several email servers of which only about 50% are encrypted. On every other server, criminals can intercept invoices, modify them with their own bank account numbers and forward them. Through address spoofing, it is even possible to send an email on behalf of someone else. Criminals can also sling a phantom invoice into the market where the value is only a few hundred euros so that there is little manual check with recipients and payment is usually automatic. Companies and institutions can prevent this with automated control mechanisms on XML invoices (or paper or PDF invoices converted to XML). The content of an XML invoice is then compared with the supplier data as known to the customer. If the combination of name, VAT number and IBAN on the invoice does not match the data in the system, an invoice sent by criminals with a modified IBAN will automatically fall out.

-

Strengthen CSR position

By paying suppliers on time and thwarting fraudsters, you are already demonstrating good behavior. And that data-driven working reduces the use of paper is, of course, obvious. But data-driven working also provides transparency and traceability of work.

2 min read

E-invoicing is becoming the norm: are you ready?

Apr 29, 2024

1 min read

Payment behavior of large companies leaves much to be desired: many invoices paid late

Apr 25, 2024

Purchase to pay software

A digital transformation is a gradual process in which adjustments must be made. It is therefore important to apply automation software that can give shape to the digital transformation, but that also matches the ambitions of the organization.

The software must seamlessly integrate purchasing and invoice processing; will have to interface with one or more ERP systems and be deployed for one or more administrations; and must be able to provide insight into all order and invoice flows in order to continuously improve the purchase-to-pay process.

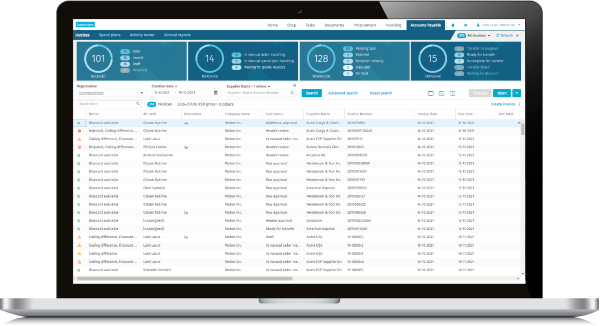

E-invoicing and invoice processing

Automatic invoice receipt and invoice recognition(e-invoicing) will replace scanning & recognition(OCR) of pdf invoices. The deployment of e-invoicing networks, will accelerate this. When invoice information is available as data, invoice processing (encoding and matching) can be automated. The degree of automation is maximized if the invoice data is validated with ERP master data, before further processing.

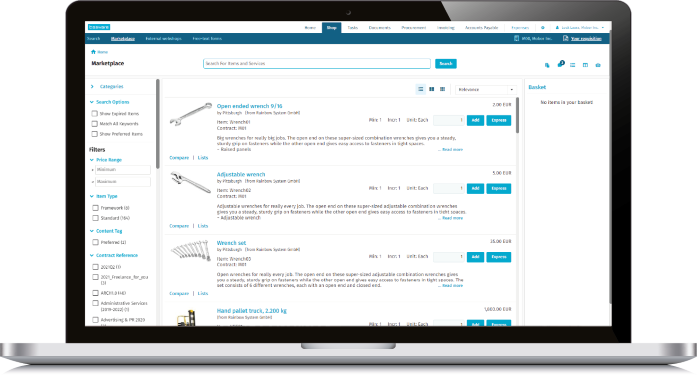

Decentralized purchasing under management

Unlike spending that serves a company's primary activity, there is much less control over spending that supports secondary activities. By working with preferred suppliers and contracts for secondary activities as well, product procurement can be offered through a central platform within the organization.

Automation takes off with process optimization

Automation of the purchase-to-pay process can reinforce existing errors and wait times and introduce new errors and wait times. To avoid this, processes must be optimized before they are automated.

Time to spar?

Want to exchange thoughts on getting a grip on the purchase to pay process? Leave a message here. We will get back to you soon.

For questions or comments that are not about our solutions, please contact us here. For support, please contact our service center.