1 min read

Digital invoice versus electronic invoice: what's the difference?

Editing ICreative

31-Jan-2018 12:02:25

The different forms of invoices still sometimes cause confusion. In particular, the difference between a digital invoice and an electronic invoice. Below is an explanation.

Digital invoice

A digital invoice is usually a PDF invoice. Suppliers often send a PDF invoice as an attachment in an e-mail. Or they send a paper invoice, which can be scanned in with a scanner or multifunctional device. The result, the scan, is usually in PDF format.

Digital invoice processing then means as much as processing PDF invoices. For example, having them sent through an automated workflow to budget holders, who review and approve the PDF invoice.

The information on the PDF invoice is entered by the accounts payable department into an accounting program, for example.

Electronic invoice

A PDF invoice has two different forms. Either as a digital image or in a machine-readable format, where the image is accompanied by data. The information on the invoice can thus be read from the image but the same information is then also available in data form. Machine-readable PDFs can thus be viewed by humans as well as by accounting programs or purchase-to-pay systems.

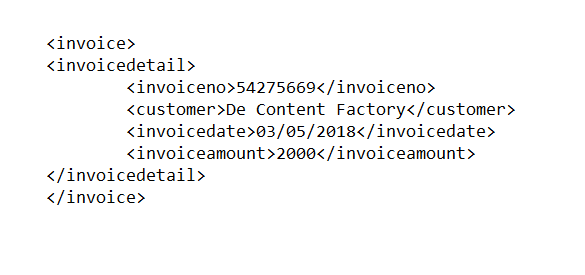

Thus, a PDF invoice can also be considered an e-invoice. Usually, the term e-invoice is reserved for XML or UBL invoices. These are invoices that are created, processed and stored sec as a data file. An XML (or UBL) invoice, is a data file in the so-called Extensible Markup Language (XML) markup language.

For example, when opening an XML data file, using a text editor, an invoice looks like this (simplified):

Een databestand kan direct door een boekhoudprogramma of purchase-to-pay systeem worden verwerkt. Althans, mits de de inhoud van het databestand wordt begrepen door het ontvangende systeem (datgene wat in het voorbeeld hierboven tussen < en > staat), aangezien hier niet één uniforme opmaak in bestaat. Een UBL-factuur, bijvoorbeeld, is opgemaakt als XML en met vaste kenmerken, zoals het kenmerk dat staat voor het factuur type.

Never miss a blog update again?

Sign up for the newsletter and automatically receive the latest blogs in your mailbox every month